Nongfu Spring "not bad money": huge dividend 9.50 billion before listing, major shareholders share close to 90%

[Text | Interface, Yuan Yingqi]

Nongfu Spring, which has repeatedly said that there is no need to list, finally decided to list on the Hong Kong Stock Exchange. The company that mainly produces "a little sweet" mineral water has a financing scale of no more than 1 billion US dollars, but it is a high probability event that it will enter the 100 billion market value club after listing.

We carefully read the prospectus submitted by Nongfu Spring to the Hong Kong Stock Exchange and found that the company had mixed feelings.

Nongfu Spring "not bad money"

Nongfu Spring was established in 1996, and its founder Zhong Liangyi holds 87.4% of the shares. The company’s main business contributes about 95% of the total operating income. The main products include drinking water, tea beverages, functional beverages and fruit juice beverages, accounting for 60%, 13%, 16% and 10% of the revenue respectively. Among them, drinking water and fruit juice beverages have grown rapidly.

Image source: Prospectus, Interface News Research Department

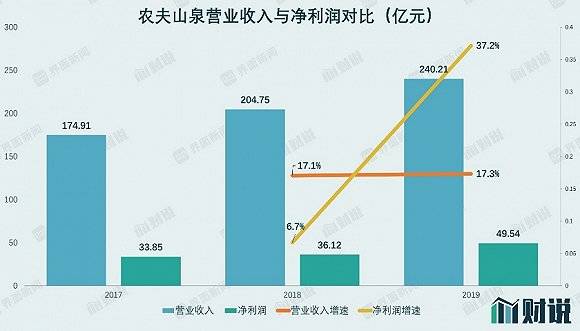

According to the prospectus, Nongfu Spring has maintained steady growth in the past three years. From 2017 to 2019, the income was 17.491 billion yuan, 20.475 billion yuan and 24.021 billion yuan respectively, with a compound annual growth rate of 17.2%. Nongfu Spring achieved net profit of 3.385 billion yuan, 3.612 billion yuan and 4.954 billion yuan in the past three years, with a compound annual growth rate of 21.0%.

Image source: Prospectus, Interface News Research Department

In 2019, the comprehensive gross profit margin of Nongfu Spring was as high as 55.4%. Mainly due to the gross profit margin of 60.2% of the largest drinking water product. The gross profit margins of other categories such as tea beverages, functional beverages and fruit juice beverages were 59.7%, 50.9% and 34.7% respectively.

In terms of net profit, the net profit rate of Nongfu Spring rose to 22.8% in 2019, of which sales expenses accounted for the largest proportion of the three fees. Specifically, sales expenses accounted for 24.2% of operating income, and the most important ones were transportation expenses and advertising expenses, which were 2.53 billion and 1.22 billion yuan respectively, accounting for 10.5% and 5.1% of operating income, respectively.

In terms of cash, Nongfu Spring adopts the first payment and then the goods transaction method, and the book receivables are very small. From 2017 to 2019, the company’s net operating cash inflow was greater than the net profit of the year, especially in 2019, the net operating cash inflow was as high as 8.73 billion yuan. From 2017 to 2019, the book structured deposits were 2.04 billion, 3.60 billion and 200 million yuan respectively. The average interest rate earned was between 4.0% and 4.9%.

The sharp decrease in cash in 2019 was due to the concentrated dividend of Nongfu Spring up to 9.50 billion yuan before listing. Among them, the major shareholders received 8.20 billion yuan. Previously, although Nongfu Spring also had annual dividends, the amount was 2-300 million yuan. And the total financing of Nongfu Spring is only 1 billion US dollars.It is certain that Nongfu Spring did not choose to go public because of a lack of funds.

What is the valuation after going public?

Master Kong Holdings, the equivalent producer of mineral water in Nongfu Spring, has been listed on the Hong Kong stock market. In 2019, Master Kong Holdings’ beverage business contributed HK $39.70 billion to operating income, which was greater than Nongfu Spring’s operating income. But net profit was only HK $3.72 billion, far less than Nongfu Spring’s 4.95 billion yuan.

At present, the market value of Tingyi Holdings is 77.20 billion Hong Kong dollars, corresponding to the price-to-earnings ratio of about 20.8 times in 2019. It is estimated that the total market value of Nongfu Spring after listing is at least about 130 billion Hong Kong dollars. In fact, Nongfu Spring is better than Tingyi Holdings in terms of profitability and growth, and the market may give a higher valuation.

According to the prospectus, the drinking water market is still in a stage of rapid development. According to Nielsen’s forecast, it is still expected to maintain a growth rate of about 10% in the next five years. Compared with the beer and condiment market, the drinking water market has more room. Based on the high concentration of the drinking water market, it is also possible to produce a leader with a larger market value than Budweiser Asia Pacific (1876.HK) and Haitian Flavor (603288.SH) in the long run. The average price-to-earnings ratio valuation of beer in the Hong Kong stock market is 30-40 times. The average valuation of soy sauce and vinegar in the class A share market is more than 40 times. Based on this, we have predicted the market value of Nongfu Spring.

Image source: Interface News Research Department

The troubles of Nongfu Spring

Although the situation is good, Nongfu Spring is not a smooth road.

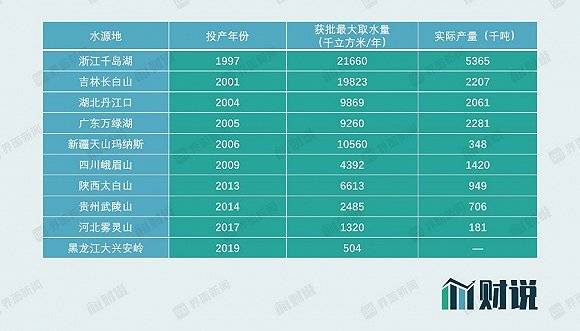

First of all, the drinking water business depends on the source of water, and the bottleneck facing the long-term growth of Nongfu Spring is the limited source of water. According to relevant laws and regulations, units and individuals who directly extract water from natural resources (such as rivers, lakes and groundwater) need to obtain a water extraction license and pay a water resource fee. Enterprises need to extract water according to the approved annual water extraction plan. Moreover, mineral water has the dual attributes of water resources and mineral resources. The production of mineral water should also apply for a mining license according to law. In other words, the scarcity of water sources on the one hand helps enterprises to establish high industry barriers, and on the other hand restricts enterprises to expand production capacity. It is conceivable that with the development of the industry, there are fewer and fewer untapped water sources.

The situation of Nongfu Spring’s newly obtained water sources in recent years is not optimistic. At present, Nongfu Spring has a total of 10 water sources. The main production bases are still Qiandao Lake in Zhejiang, Changbai Mountain in Jilin, Danjiangkou in Hubei and Wanlv Lake in Guangdong, which were obtained before 2005. With the increase in environmental awareness, the water withdrawal from water sources obtained by Nongfu Spring in recent years has become smaller and smaller. In 2019, the newly obtained water withdrawal from water sources was only 504 thousand cubic meters per year. Although the approved water withdrawal from water sources currently owned by Nongfu Spring is much larger than the actual production capacity of the company, the company does not have the problem of insufficient water withdrawal in the short term. However, products concentrated in water sources in Zhejiang, Guangdong, Jilin and Hubei are also limited by the transportation radius.

Nongfu Spring has less water sources that can produce mineral water, which is not conducive to product upgrades in the future. In addition, the average ton price of Nongfu Spring drinking water has declined for two consecutive years, the company explained, because of the increase in sales of large-packaged drinking water with lower unit prices. In the short term, Nongfu Spring may face the risk of lower gross margins.

Due to the scarcity of domestic water sources, Nongfu Spring has begun to go overseas. Nongfu Spring has acquired Otakiri Springs, a New Zealand bottled water company. The prospectus revealed that Nongfu Spring will look for suitable acquisition targets in the future. However, the overseas market is more mature than the Chinese market, and the growth space is limited. The risk of "going out" is really not small.

Image source: Prospectus, Interface News Research Department

Secondly, Nongfu Spring also faces the problem of "succession". The company has five executive directors. Among them, the founder Zhong Shuzi currently serves as the chairperson and general manager of the company, with a shareholding of 87%. Appropriately reducing the founder’s shareholding ratio through listing can achieve the effect of optimizing the shareholding structure and reducing decision-making risks. At present, Zhong Shuzi is 66 years old and has been deeply involved in the operation of Nongfu Spring. Another executive director, Guo Zhen, deputy general manager in charge of the overall operation and production of Nongfu Spring, is also 62 years old. Zhong Shuzi, the son of Zhong Shuzi, is currently a non-executive director of the company and does not participate in daily operations. Zhong Shuzi joined the group in 2014 and is currently the general manager of Yangshengtang (Nongfu Spring Holding Company) Brand Center.

It is worth mentioning that at the same time as the listing of Nongfu Spring, another company controlled by founder Zhong Shanyuan, 603392.SH, landed on the class A share main board on April 29. The current market value is 6 billion yuan, and the daily limit has not been opened. In the Hurun wealth list in 2020, Zhong Shanyuan was listed with 14.10 billion yuan. With the listing of the above two companies, his worth is expected to rank among the top five on the rich list.